Excellent Ideas To Picking Credit Card Apps

Wiki Article

How Do I Check To Find Out If My Credit Cards Were Reported Stolen?

Follow these steps to check whether your credit card was discovered to be stolen in the USA: Contact the credit card company you use

Contact the copyright that is on the back of your credit card.

Inform the representative of your desire to verify whether or not the credit card was reported stolen or lost.

Verification might require you to supply personal information, such as your credit card number as well as name.

Check Your Account Online

Log in to your online banking or credit card account that is linked to the card in question.

Check for any alerts or messages regarding the state of your credit card.

Examine the latest transactions to identify suspicious or unauthorized activity.

Monitor Your Credit Report

Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) through AnnualCreditReport.com.

Check the report to see if there are any credit inquiries or accounts that you don't recognize. This could be an indication of fraud.

Security Freezes and Fraud Alerts-

Think about putting a freeze on your credit report or fraud alert on your report if fraud or identity theft are suspected.

A fraud warning alerts creditors to the additional actions they must take to verify identity before offering you credit. In addition, a security freezing restricts the access to your credit file.

Keep an eye out for any suspicious behavior and report it.

Check your credit card statements frequently and immediately notify any suspicious or unauthorised transaction.

Report any suspected cases to the Federal Trade Commission. You can also file a report at your local law enforcement agency.

Contacting your credit card issuer, reviewing your account activity online, monitoring your credit report, and staying vigilant for any signs of unauthorized activity, you can take proactive steps to protect yourself against credit card fraud and address any potential issues with a reported stolen credit card.

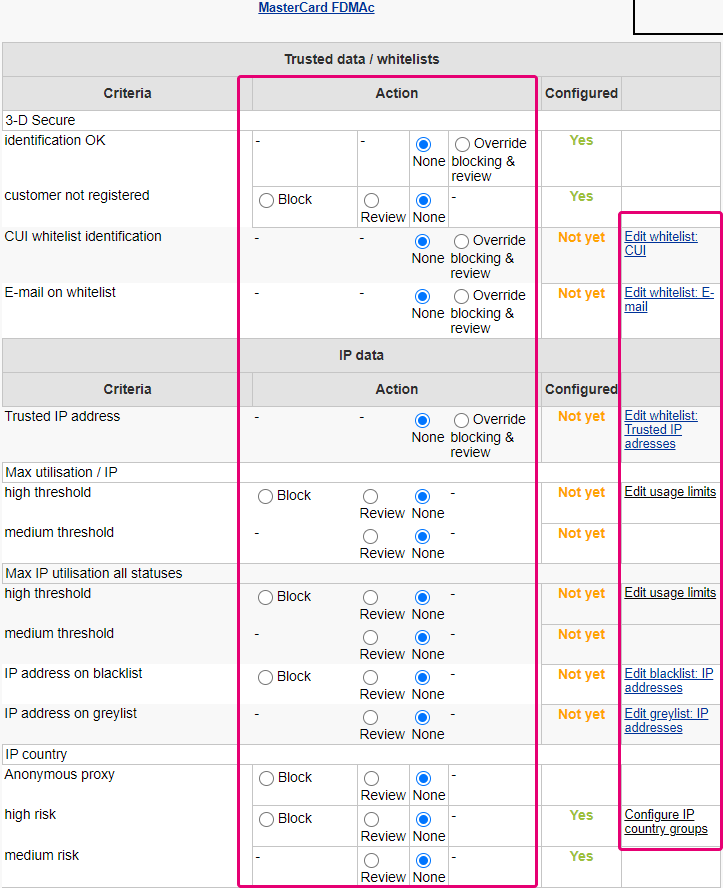

What Do I Mean By My Credit Cards Are On A Blacklist?

A Blacklist's presence can hinder a card's usage or transactions until an issue is solved. There are numerous reasons for why a credit card might be placed on a blacklist.

The card can be blocked for security purposes is possible if there are suspicions of fraud.

Security Issues In the event of indications of a breach (unauthorized access or data breaches that involve cards, or unusual spending patterns) the card may be tagged for security reasons.

Identity Verification Issues: When the cardholder is not able to prove their identity, it can temporarily disable the card temporarily. This can happen when there are additional verification requirements.

Card Lost or Stolen- If a card has been declared lost or stolen the issuer can place a block to prevent any unauthorised use of the card until a new one is issued.

Suspicious Activity Indicators - Any behaviour or activity that is connected to the card is suspicious, such as multiple declined transactions, geographic irregularities, or unusual spending patterns, may trigger a temporary block.

A card listed as blacklisted may restrict the ability of the cardholder to get credit, or to make purchases with the card. This may be until the issuer of the card confirms the authenticity of the account or addresses any security or fraud concerns. Cardholders need to immediately contact their card issuer to report the issue and to verify the transactions and address any security issues.

What Are The Requirements For Someone Who Can Run An Account For A Credit Card In A List Application?

The process of comparing credit card numbers to a blacklist or checking for fraud involving credit cards is normally performed by authorized professionals within banks or law enforcement agencies or cybersecurity firms. They are: Fraud analysts- Trained professionals who work in banks and specialize in identifying, investigating, and preventing fraudulent credit card activity. They employ specialized software to detect patterns.

Cybersecurity experts - Professionals who are experts in the field of cybersecurity. They are able to monitor and spot cyber-attacks, including compromised credit card data. They work on the prevention of data breaches, by analyzing data to identify signs of compromise, and implementing security measures.

Law Enforcement Officials - Specialized units or individuals within law enforcement agencies who investigate financial crimes, such as credit card fraud. They have the databases and resources necessary to track fraudulent activity.

Compliance officers are experts who ensure that financial institutions adhere strictly to the laws and regulations regarding transactions in the financial sector. They can oversee procedures for identifying suspicious activities that involves credit card.

The accessibility of databases that hold blacklists for credit cards and the authority to validate credit card numbers using such lists is strictly regulated. It requires proper legal authorization such as being component of an investigation into financial crime or obtaining permission from authorized entities.

They employ protocols, software and legal procedures, as well as special protocols and software to check credit card information against blacklists, and to maintain strict security and privacy guidelines. To ensure that your credit card information is not hacked, always rely on trusted experts and institutions. Unauthorized attempts to access or use credit card blacklists could lead to legal consequences. Take a look at the top savastan0 cvv for website examples.